Inclusionary Zoning

Background Information and talking points

Overview

In an effort to address rising housing affordability and demand, local governments have pursued inclusionary zoning (IZ) policies looking for an answer. These policies, also known as “inclusionary housing” or “workforce housing,” require or encourage new market-rate developments to set aside a certain number of housing units to be affordable or rented at a below market-rate rent. In order to be successful at driving the development of affordable housing, inclusionary zoning initiatives must provide the proper incentives.

Problem

Most inclusionary zoning policies are mandatory rather than voluntary. While well intended, mandatory inclusionary zoning ordinances often lack the proper incentives, constrain the market, and increase demand. This is because inclusionary zoning ordinances are, in effect, taxes on new development. When discussing affordable housing, economists Benjamin Powell and Edward Stringham stated, “Economic theory and evidence demonstrate that imposing price controls and taxes on housing is one of the worst ways of encouraging the production of housing.”[1] Developers that construct projects in mandatory IZ markets will attempt to offset costs from affordable housing by raising their market rate prices, thereby making rent more expensive for median income households.

In some cases, mandatory IZ programs provide the option of paying a fee in lieu of constructing affordable units. Unfortunately, due to market demands and cost drivers, developers will often opt to pay the fee over building affordable units, which is counterproductive to addressing the growing demand for affordable housing.

The IZ program fails if the production of affordable units in the development increases market prices or reduces the number of units being built. The below market-rate rents will restrict the overall profit for the project, thus making it harder to finance with investors expecting a specific rate of return. Rent restrictions automatically reduce the profit a developer will make, which in turn reduces the return the developer can deliver to investors. In light of the unique challenges posed by rent-restricted units, IZ program incentives will make the most impact if they are designed to offset costs incurred during the early phases of the project.

It is important for incentive programs to reduce front end costs because these initial expenses, including regulatory costs, can account for up to 30% of the overall cost of development. A report by the South Florida Housing Studies Consortium concurred with this fact when it stated, “... national best practice research indicates that IZ works best when it is part of a broader, comprehensive set of affordable housing and community development tools, programs, and policies. County leadership needs to organize and commission the development of a region-wide, comprehensive housing affordability solutions policy, program, and funding toolbox immediately.” [2]

Background

Inclusionary zoning was designed to provide affordable housing for low to moderate income residents through the private market. Since 1970, inclusionary zoning ordinances have been introduced throughout the nation, including Florida. A large majority of inclusionary zoning programs mandate developers to include affordable housing; a select few are voluntary.

Voluntary IZ ordinances do not require the developer to produce a certain number of affordable units, but rather offer incentives in exchange for the developer willingly trading market rate units for affordable housing units. These programs allow developers to determine whether or not participation in the incentive program will be cost-effective for their unique business model. Interestingly, one incentive most programs contain is expedited review; however, Florida Statute already mandates that all affordable housing projects be expedited to a greater degree than other projects.[3]

The implementation of an inclusionary zoning policy at the local level will vary. Typically, the developer is required to set aside 10-30% of the development’s units to be designated as affordable or workforce housing based on certain household income thresholds. Some local programs will give the developer the option to build the affordable units on-site or off-site. These programs may also allow a developer to pay a fee in lieu of constructing affordable or workforce housing units. In many cases, these fees are deposited into an affordable housing trust fund that is designed to subsidize future affordable housing construction projects or other housing initiatives at the local level.

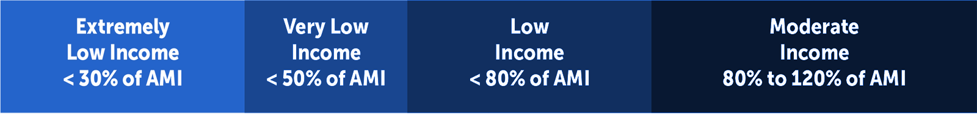

Generally speaking, housing affordability is based on how much money a household earns relative to the “area median income” (AMI) and the portion of the household’s income that is spent on housing. It is considered a best practice for a household to spend 30 percent or less of its income on housing. The U.S. Department of Housing and Urban Development (HUD) establishes AMI threshold categories using annual estimates of the median family income for each county (Figure 1).

Figure 1: Area Median Income Categories

Housing affordability is also addressed by various programs that are available at the state and federal level. For example, Florida has the State Housing Initiatives Partnership Program (SHIP) and the State Apartment Incentive Loan Program (SAIL). SHIP and SAIL attempt to increase economic impact by leveraging private sector loans and equity, providing $4 to $6 for every dollar of state funding. SHIP was designed to create partnerships through funds granted to counties and municipalities for the use of creating affordable housing.[4] On the other hand, SAIL primarily provides low-interest loans to a developer for the construction or rehabilitation of affordable housing for low-income residents.[5]

At the federal level, developers have access to the Low-Income Housing Tax Credit (LIHTC). The LIHTC is a public/private partnership that promotes affordable housing by leveraging federal dollars with private investment to stimulate new economic development. Under the program, investors can claim tax credits on their federal income tax returns, which in turn makes it financially feasible for apartment communities to rent below market rates.[6] Unfortunately, both the state and federal program funds are extremely competitive and require extensive knowledge of the bureaucratic application process. As a result, many developers are not able or simply do not have the expertise that is required to take advantage of these funding mechanisms.

Florida-Specific Legislation Related to Inclusionary Zoning

In 2019, the Florida Legislature passed HB 7103, which the governor signed into law. This bill will prohibit local governments from enacting a mandatory inclusionary zoning requirement unless the municipality offers incentives that fully offset all costs to the developer for his or her affordable housing contribution.

Examples of Inclusionary Zoning Mandates in Florida

Palm Beach County

Palm Beach County created a Workforce Housing Program (WHP) in 2006. The county instituted a mandatory workforce housing program, which required all developments with 10 units or more to set aside 5% of the units for inclusionary housing. Since the inception of the program, only 873 multifamily WHP-designated apartment homes have been added into the market.[7] This low success rate is because many developers in Palm Beach County have opted to pay the fee in lieu of building affordable housing units.[8]

Miami-Dade County

Miami-Dade County passed a voluntary inclusionary zoning ordinance in 2016. The county’s Workforce Housing Development Program is an important vehicle for improving affordable housing but is lacking the necessary incentives that would fully stimulate development in the multifamily housing market. Under the program, density bonus is the only incentive used to stimulate housing development.

In accordance with the program, any multifamily development with 20 units or more that accommodates at least 5% affordable units is provided at least a 5% density bonus, which allows more units than would otherwise be premitted. The density bonus can increase if the number of set-aside affordable units is increased.[9] A report on Miami-Dade County’s ordinance by the South Florida Housing Studies Consortium states, “Our economic analysis of the ordinance indicates that its incentive structure, built on density bonuses, probably will not supply the level of economic incentive local developers require to include workforce units in market-rate housing development projects.” [10]

City of Orlando

Orlando does not have an inclusionary zoning mandate but the city provides many incentives to stimulate the construction of affordable housing. If a project agrees to supply affordable units, the city provides a whole host of incentives to help balance out the developer’s up-front costs. The Orlando program has been successful in its production of affordable housing. Since Orlando adopted the Voluntary Affordable Program in 1993, 18,168 affordable multifamily units have been created.[11] Compared to Palm Beach County’s Workforce Housing Program, Orlando has created far more affordable units.

According to researcher Jenny Schuetz and others, IZ programs with incentives that equal or exceed the loss that a developer would incur on IZ units were more successful than ones that did not.[12] Although Schuetz’ study did not explore the City of Orlando, the study’s findings are consistent with the success of Orlando’s voluntary incentive program. Orlando’s program is far more successful at creating affordable units because the city offers a variety of options to help offset the losses incurred by developing affordable housing.

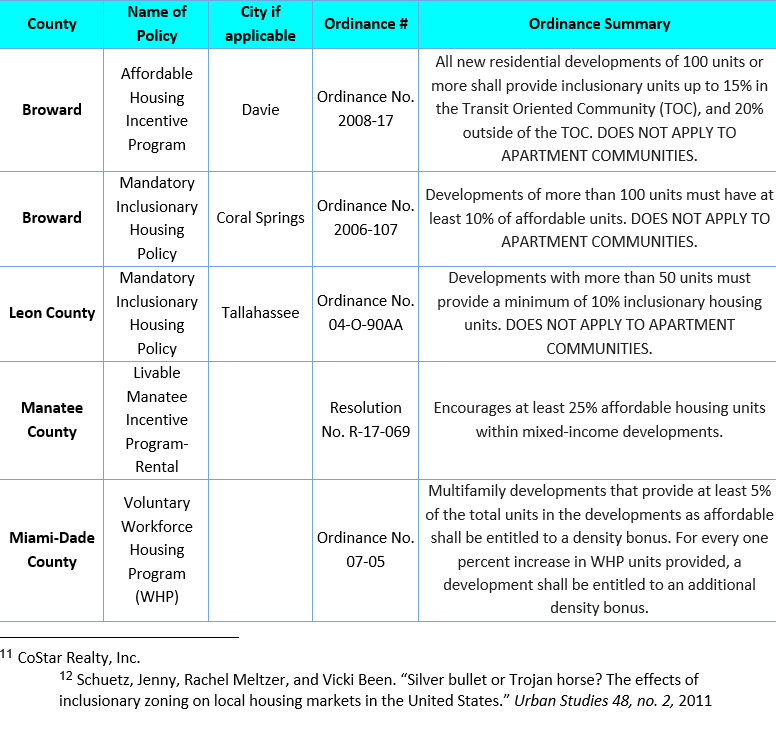

Florida cities and counties have implemented a variety of programs related to inclusionary zoning (Figure 2).

Figure 2: Programs Related to Inclusionary Zoning in Florida

Alternative Solutions

The simple existence of a voluntary IZ ordinance at the local level does not guarantee the construction of affordable units. Evidence suggests that the way a program’s incentives are structured determines the degree to which the program will succeed. For example, in order for Miami-Dade County’s program to be successful, the county needs to adopt more incentives comparable to Orlando’s voluntary development plan.

To avoid what is happening in Palm Beach County, participation in the IZ program must be voluntary with the proper incentives provided to housing developers who choose to participate. Such incentives should attempt to offset the developer’s initial costs and the excess regulatory requirements or financial risk associated with building affordable units that often deter the average developer from constructing affordable housing. Reducing or eliminating front-end costs were found to be more important to a developer than even larger incentives such as density bonuses.[13]

Incentives

A properly incentivized IZ policy will address all aspects of development to successfully stimulate the construction of affordable housing. Examples of these comprehensive incentives include:

- Providing large density bonuses, allowing the number of bonus market rate units to be three times the number of affordable units.

- Impact fee waivers.

- Off-site production of affordable units.

- Tax abatement scaled to the number of affordable units in a development.

- Elimination of project fees.

- Expedited review.

- Design flexibility and reduced parking requirements.

- Local finance program (infrastructure funding).

- Option of a fee in lieu of units.

Example of a Potential Strategy

If an inclusionary zoning ordinance is proposed by your local government, review the Florida Apartment Association’s (FAA) Housing Affordability Toolkit[14] And consider these questions:

- Is an inclusionary zoning ordinance necessary?

- Housing affordability concerns can be addressed without inclusionary zoning.

- A voluntary incentive program will create far more affordable housing than a mandatory IZ ordinance. Compare the overall success of Orlando’s robust voluntary incentive program against Palm Beach County’s mandatory program, which has yielded poor results.

- Is the program mandatory or voluntary for developers?

- Mandatory programs can constrain the market, but voluntary IZ programs with strong incentives may actually bolster the market.

- Does the program contain the proper incentives?

- Voluntary IZ programs within a weak market and with poor incentives may yield the same results as a mandatory IZ program. Therefore, it is important that policymakers are made aware of the critical need for strong incentives to help fill the financial gap in affordable housing construction projects and thus stimulate development.

- The program should include incentives that directly offset affordable unit costs, with a particular focus on the up-front costs that can serve as a barrier to the construction of affordable units.

- Which populations are eligible for participation in IZ?

- There are varying levels of affordability in terms of AMI. Local governments select different levels of AMI based on the segment of the population or target audience they are trying to help. Therefore, it is important to understand the population the local government intended to target with the IZ policy.

- Which types of developments are covered and how many units are required to be set aside for affordability under the ordinance?

- The number of units that are required to be set aside as affordable units determines the supply of affordable units. Ordinances that set too high a threshold for the number of affordable units can effectively disrupt the overall financial viability of potential construction projects, making it less likely for a developer to construct an apartment community.

- Does the developer have the option to pay a fee in lieu of building affordable units?

- Should there be an in-lieu option, then the fund must be earmarked for a local housing trust fund that is used for grant funding. The funds will be provided to developers for affordable housing construction.

- Does the local government maintain the ability to collect data regarding the successfulness of the program?

- The continuation of a productive policy will be based on the success of the program, in particular, the profit margins and likelihood that a developer will build another affordable or mixed development in same market.

Florida Apartment Association’s (FAA) Housing Affordability Toolkit

In June 2019, FAA and the Apartment Association of Greater Orlando (AAGO) composed the “Housing Affordability Toolkit” to offer potential policy solutions that could be applied throughout the State of Florida. This document is a public-facing document that can be used when meeting with local policymakers to discuss affordable housing related issues.

Prior to drafting the Housing Affordability Toolkit, FAA and AAGO surveyed apartment developers who operate throughout the State of Florida. The survey measured multifamily housing construction barriers and the level of interest in various affordable housing incentives designed to increase affordable housing supply. The survey data revealed that some incentives drive development, while others merely support it. Incentives that offset some of the developer’s upfront costs, such as impact fee waivers or property tax discounts, are more effective at driving new development than density bonuses.”[15]

For a full copy of this report, please visit www.faahq.org and look for the PDF copy, which is available under the “Research” tab located on the homepage.

Additional Resources:

[1] Benjamin Powell & Edward Stringham, "The Economics of Inclusionary Zoning Reclaimed." How Effective are Price Controls?, 2005.

[2] The South Florida Housing Studies Consortium. “Assessing the Implementation and Impacts of Inclusionary Zoning.” The Dynamics of Housing Affordability in Miami-Dade County, April 2017

[3] FLA. STAT. § 163.3177(6)(f)3, 2018.

[4] Florida Housing Finance Corporation. State Housing Initiative Program (SHIP) https://www.floridahousing.org/programs/special-programs/ship---state-housing-initiatives-partnership-program

[5] Florida Housing Coalition Inc. Affordable Housing Funding Sources. 3 September 2014

[6] Congressional Research Service. An Introduction to the Low-Income Housing Tax Credit. 27 February 2019

[7] Palm Beach County Planning, Zoning & Building Department. “Attachment 3: Breakdown of Residential Projects with Workforce Housing Program Units,” August 2018.

[8] Swisher, Skyler. “County Trying to Spur Development of Affordable Housing as Rents, Prices Rise.” South Florida SunSentinel, 6 April 2018.

[9] Miami-Dade County Ordinance No. 16-138.

[10] The South Florida Housing Studies Consortium. “Assessing the Implementation and Impacts of Silver bullet or Trojan horse Inclusionary Zoning.” The Dynamics of Housing Affordability in Miami-Dade County, April 2017.

[11] CoStar Realty, Inc.

[12] Schuetz, Jenny, Rachel Meltzer, and Vicki Been. “Silver bullet or Trojan horse? The effects of inclusionary zoning on local housing markets in the United States.” Urban Studies 48, no. 2, 2011

[13] Florida Apartment Association, & Apartment Association of Greater Orlando. Multifamily Housing Developer Survey, 10 May, 2019.

[14] Florida Apartment Association. Housing Affordability Toolkit, June 2019

[15] Florida Apartment Association. Housing Affordability Toolkit, June 2019