Source of Income

Background Information and talking points

Overview

In light of housing affordability concerns throughout the state, some local governments in Florida have taken steps to institute policies that are commonly referred to “source of income protections.” These policies require property owners to accept any lawful source of income, which includes federal Section 8 vouchers. In the eyes of local governments, this policy prevents property owners from discriminating against a potential resident merely on the grounds of the individual’s source of income.

Problem

Source of income (SOI) protections are problematic for both property managers and the voucher holders that they intend to help. These policies require independent property owners to comply with the federal requirements under the Section 8 Voucher program. These cumbersome bureaucratic requirements include but are not limited to: additional inspection requirements; a three-way lease between the housing provider, the resident, and the public housing authority; multiple delays during the lease process; and increased paperwork to accompany the traditional lease. It is also important to note that Section 8 vouchers cannot be used to pay for any property damage as a result of the resident, which could in turn raise the financial risk for property owners who rent to a voucher holder. Overall, these administrative burdens delay the leasing of the apartment and create significant cost increases for the property owner.[1]

In addition, these policies negatively impact the low-income individuals that they are designed to help. SOI protections create a disincentive for the construction of additional apartment communities, which thereby decreases the production of housing. This overall reduction in supply increases demand, which can ultimately lead to higher housing costs for all renters.

Background

The Section 8 program is a federally funded and operated initiative under the Department of Housing and Urban Development (HUD) that was designed to provide housing assistance to low-income families, disabled individuals, and the elderly. Generally speaking, individuals are considered low-income if the family’s income does not exceed 50 percent of the median income for the county or city in which the family will live. It is important to note however, that federal law requires that 75 percent of the vouchers provided under the program must be given to individuals whose incomes do not exceed 30 percent of the area median income (AMI).[2] The acceptable AMI levels, which vary by location, are published by the federal Department of Housing and Urban Development.

Section 8 Vouchers can then be used to secure any housing option that meets the program requirements. Under the program, a HUD Housing Assistance Payments Contract (HAP contract) is required. This HAP contract drastically differs in content and process from a traditional lease agreement. Under the agreement, participants typically pay 30 percent of their adjusted gross income for rent and a local public housing agency will use federal funds to administer the vouchers to pay the remaining balance. Once the voucher holder secures a housing option, the rental subsidy is paid directly to the property owner by the local public housing agency. Overall, this program assists more than 2 million low-income families each year. [3]

Participation in the Section 8 program is voluntary for housing providers and HUD has given property owners the responsibility of properly screening applicants to determine their eligibility. The U.S. Housing Code states, “The owner is responsible for screening and selection of the family to occupy the owner's unit.”

Congress designed the Section 8 program as a voluntary initiative based on the additional requirements and financial constraints placed on property owners who elect to participate in the program. For example, as previously noted, Section 8 Vouchers cannot be used to pay for damage [LC2] to the property. In an effort to mitigate some of this financial risk, local or state governments have established what are commonly referred to as “landlord mitigation funds.” These funds are usually composed of both public and private resources. The money in the fund is available to cover costs that are incurred by the property owner that cannot be reimbursed by the Section 8 Voucher.

Additionally, it is important to keep in mind that property managers who do accept Section 8 Vouchers typically have designated staff who are tasked with the compliance components of the program. Due to the cumbersome nature of the program requirements and the additional inspections, which often delay the leasing process, many property owners have decided not to participate in the Section 8 Voucher program.

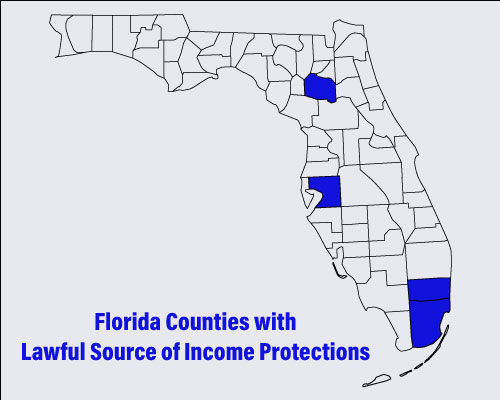

Examples of SOI Protections in Florida

In Florida, Miami-Dade, Broward, Alachua,and Hillsborough counties have passed and implemented SOI protections. Miami-Dade was the first local government to enact SOI protections in 2009.[4] The Miami-Dade ordinance prohibits discrimination based on race, color, religion, ancestry, national origin, sex, pregnancy, age, disability, marital status, familial status, sexual orientation, veteran status or source of income. Source of income is defined as, “the lawful, verifiable income paid directly to a tenant or paid to a representative of a tenant, including but not limited to Section 8 Housing Choice Vouchers, Supplemental Security Income, Social Security, pensions and other retirement benefits.” In addition, Miami-Dade has a County Commission on Human Rights. Citizens can file discrimination complaints with this Commission, which is responsible for investigating and conciliating discrimination complaints that relate to local, state, and federal laws.

In 2017, Broward County established similar SOI protections. Under the Broward County ordinance, lawful source of income is defined as, “the origin or cause of a legal gain or recurrent benefit, often measured in money or currency, including, but not limited to, income derived from Social Security, Supplemental Security Income, child support, alimony, veteran’s benefits, disability benefits, unemployment, pension and retirement benefits, an annuity, a gift, an inheritance, the sale or pledge of or interest in property, or any form of federal, state, or local public or housing assistance or subsidy, including Housing Choice Voucher Program or ‘Section 8′ vouchers, whether such income is received directly or indirectly by the renter or purchaser and even if such income includes additional federal, state, or local requirements.”[5]

Alachua County passed an SOI ordinance in 2019. In addition to adding lawful source of income to the list of protected classes, the language provides protections against housing discrimination for victims of dating violence, domestic violence, or stalking. In 2020, the City of Gainesville followed the county's approach and established their own SOI protections, which also included protections for victims of dating violence, domestic violence, or stalking. It is important to note that multifamily properties were excluded from the lawful source of income requirements under the county's ordinance as introduced. However, the exemption for multifamily properties was later removed via an amendment that was offered by Commissioner Robert Hutchinson on the same day that the ordinance was voted on and passed by the county.

The new policy defines lawful source of income as: "The lawful, verifiable income paid directly to a tenant or paid to a representative of a tenant, including but not limited to, income derived from Social Security, Supplemental Security Income, child support, alimony, veteran’s benefits, disability benefits, pension and retirement benefits, or any form of federal, state, or local public, food, or housing assistance or subsidy, including assistance from the Supplemental Nutrition Assistance Program (SNAP) and the Housing Choice Voucher Program or ‘Section 8’ vouchers, whether such income is received directly or indirectly by the renter or purchaser and includes supplemental income.”[6] As a result of these policy changes, property owners in Broward, Miami-Dade, and Alachua must consider a Section 8 Voucher when assessing an individual’s application and determining their ability to pay rent.

Hillsborough County adopted SOI protections and a Tenants Bill of Rights on March 3, 2021. The county defines Lawful Source of Income as, "1) a lawful profession, occupation or job; 2) any government or private assistance, grant, loan or housing assistance program or subsidy, including but not limited to Housing Choice (Section 8) Vouchers and Veterans

Affairs Supportive Housing (VASH) Vouchers, Social Security, and Supplemental Security Income; 3) a gift, an inheritance, a pension or other retirement benefits, an annuity, trust income, investment income, alimony, child support, or veteran’s benefits; or 4) the sale of property or an interest in property."

As noted above, the Hillsborough ordinance imposed other requirements on the housing provider in the Tenant Bill of Rights. The new ordinance requires housing providers to provide the tenant with a copy of the Notice of Rights established by the county. Any existing lease agreements will be required to provide the tenant with the Notice of Rights at the time of lease renewal. Tenants with rental terms of 30 days or less are not required to receive the Notice of rights. In addition, the ordinance imposes a late fee notice.

The ordinance states that, "This written notice shall be separate from any notice requirements provided for

in a Rental Agreement, and shall be required each time a new Late Fee is assessed." The notice must include the amount of the fee, the justification for the late fee, the amount due at the time of the notice and if late fees will continue to accrue, a statement outlining the rate at which the fees will continue to accrue and a reference to the language in the rental agreement which establishes the amount of late fees to be assessed. This written notice can be delivered via email, on paper delivered via certified mail, on paper posted to the front door, or on paper hand delivered to the tenant.

Proof of compliance with this section can be demonstrated with a copy of the email, a written and dated letter that has a dated certification from USPS of delivery, a time-stamped photograph of the letter posted on the tenant's front door, or a signed and dated affidavit by the delivery person certifying hand delivery of the notice to the tenant and the date delivered.

Enforcement penalties for the new ordinance will begin July 1, 2021 and a violation is punishable by a fine of $500 for a first and any subsequent offenses. Click here to read an update from the Bay Area Apartment Association regarding this ordinance.

Alternative Solution

If local governments are passionate about assisting low-income families and making housing assistance more accessible, policymakers should first and foremost urge Congress to reform the program and streamline the requirements to make it more business friendly. Such reforms would enhance housing providers’ voluntary participation in this important program. Additionally, local governments should ask Congress to increase funding for this program since it is the most effective resource for helping families in need secure quality housing.

An alternative solution could include the creation of a voluntary incentive program that provides property tax relief for multifamily properties that accept Section 8 Vouchers. This would provide a direct financial incentive that could help drive voluntary, rather than mandatory, participation in the Section 8 Voucher program. In addition to this incentive, local governments could establish a Landlord Mitigation Fund, similar to the State of Utah’s, to help offset some of the financial risk associated with renting to a Section 8 Voucher holder.

In the event SOI protections are enacted at the local level, such ordinances should not require private property owners to participate in the federal government’s voluntary Section 8 Voucher Program. For example, the following language could be added to preserve the voluntary nature of the Section 8 Program: “Lawful source of income does not include Section 8 Vouchers. A landlord's refusal to participate in the Section 8 Program does not constitute source of income discrimination.”

Example of a Potential Strategy

Please note, the steps outlined below are intended to be an example of a general strategy. In the event your association is engaging a local government on an SOI ordinance, you should analyze the specific language that was introduced and craft your strategy accordingly.

- Create a visual aid that showcases the timeline differences between a traditional lease and a Section 8 Lease. (See enclosed example from NAA.)

- Meet with local policymakers to discuss:

- The industry’s support for the voluntary nature of the Section 8 program.

- The additional and often overly cumbersome requirements property owners must comply with under the program.

- The general resident screening process utilized by the apartment industry, which is applied equally to all applicants, regardless of their source of income.

- Gather testimonials from association members (both those who do and those who do not accept Section 8 Vouchers) and use these statements to craft a letter to local policymakers opposing the establishment of SOI protections that would mandate participation in the Section 8 Voucher program.

- In the event the passage of an SOI ordinance is inevitable, push for an amendment to clarify that SOI protections do not require participation in the voluntary Section 8 Voucher Program.

- This strategy could also include advocating for an establishment of a landlord mitigation fund to offset some of the financial risk associated with property damage that results from a Section 8 Voucher lease holder. (See Utah resource below.)

Additional Resources:

- NAA Source of Income Flow Chart

- Florida Specific Chart with Links to Ordinances

- SOI Risk Mitigation Funds

- St. Pete Call to Action Letter Drafted by FAA

- FAA SOI Talking Points

[1] https://www.nmhc.org/advocacy/issue-fact-sheet/section-8-housing-choice-program-fact-sheet/

[2] https://www.hud.gov/topics/housing_choice_voucher_program_section_8

[3] https://www.nmhc.org/advocacy/issue-fact-sheet/section-8-housing-choice-program-fact-sheet/

[4] https://library.municode.com/fl/miami_-_dade_county/codes/code_of_ordinances?nodeId=PTIIICOOR_CH11ADI_ARTIGEPR

[5]https://library.municode.com/fl/broward_county/codes/code_of_ordinances?nodeId=PTIICOOR_CH16_1-2HURI

[6] Alachua County No. 2019-11